Saur in figures

2,3 billions euros

Revenues

More than 25

Countries served

12,000

Employees

20 millions

Consumers

Our legacy: over 90 years of commitment

Founded in 1933 by Pierre Crussard as the Société d’Aménagement Urbain et Rural (Saur), we began by designing and operating water production plants. Our first water service concession was signed in 1934 with the community of Villejoubert in southwest France. In July 2018, the European EQT fund acquired Saur, marking a new era of growth and increased worldwide impact.

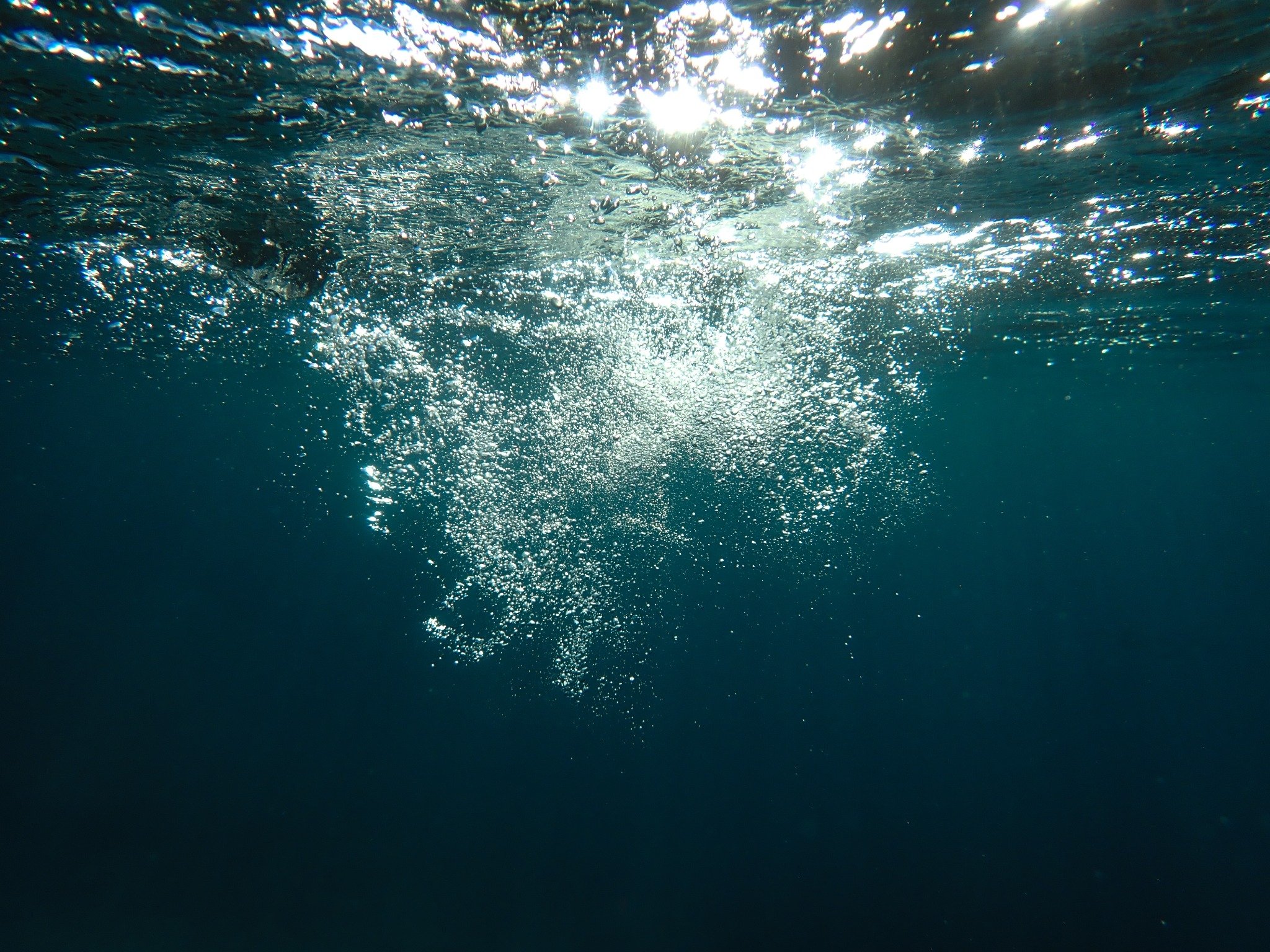

Vision 2030: championing the water transition

At Saur, we recognize the pressing challenges our world faces regarding water resources. Our ambition is to become the champion of the water transition by 2030, promoting responsible water management and ensuring universal access to this vital resource.

We are committed to give water back the value it deserves, integrating sustainability into every aspect of our operations, and supporting communities, industries, and the planet in building a cleaner, more sustainable future.

Innovation at the heart of our business

Issuing the first blue bonds in the water sector

In 2024, Saur became the first water company to issue blue bonds, raising €550 million to finance projects dedicated to protecting and restoring water resources. These funds support initiatives such as water production and distribution, wastewater treatment, and desalination technologies aimed at minimizing environmental impact.

This pioneering move underscores our commitment to integrating environmental responsibility with financial innovation, reinforcing our role as a leader in sustainable water management.

Driving sustainable solutions thanks to collaboration

Innovation is at the heart of our strategy. Our partnership with InovaYa, a young innovative company specializing in advanced water filtration and treatment technologies, exemplifies our commitment to developing sustainable and intelligent water management solutions. This collaboration aims to revolutionize water management, particularly in urban areas, by creating miniaturized water treatment systems suitable for various building types.

Embracing digital transformation

Recognizing that traditional solutions are insufficient for the water transition, we've invested €200 million in digital technologies over the past three years. Our goal is to automate 80% of activities by 2025 through Artificial Intelligence (AI), enabling smart management of infrastructure facilities and optimizing resource use.

Our commitment to sustainability and ethics

Saur's sustainability eoadmap outlines nine actionable commitments, including accelerating responsible innovation, reducing water consumption, promoting the reuse of treated wastewater, and contributing to local economic and social life.

We've also become the first French water company to be certified compliant with the international ISO 37001 anti-corruption management system standard, reflecting our dedication to ethical business practices.

Our locations worldwide

On every continent of the world, Saur deploys its mission in more than 20 countries: to make every drop of water a precious resource, by combining local expertise with a global commitment to sustainable water management.

- Europe: Cyprus, France, Ireland, Italy, Netherlands, Poland, Portugal, Serbia, Spain, Switzerland, United Kingdom

- Overseas France: Guadeloupe, Reunion Island, Martinique, Mayotte, Saint-Barthélémy, Saint-Martin

- Middle East: Saudi Arabia, United Arab Emirates, Qatar

- America: United States

- Asia: Singapore