Revenues: €1 675m, up +16.7%

Organic growth*: +8.4%

EBITDA*: €245m, up +31.5%

Free cash flow*: €103m, up +15%

Operating income: €66m, a significant increase of 37%

Leverage*: 3.6x as of 31st December 2021

Outlook 2022:

- Revenue growth: Double digits

- EBITDA: Profitable growth

- Committed to investment grade rating

Paris, April 5th, 2022. The Supervisory Board, chaired by Jürgen RAUEN, convened on April 1st, 2022 in Paris to review the accounts of the Saur Group for the year ended December 31st, 2021. Following the Board’s recommendation, Patrick Blethon, Executive Chairman of Saur, adopted the accounts for the year ended December 31st, 2021.

"2021 has been a tremendous year for Saur. Our team successfully executed through a challenging environment to deliver outstanding results, including 16.7% revenue growth and 31.5% EBITDA growth. We were particularly pleased with the performance of our water services business in France and are progressing in the market. 2021 was a pivotal year in our quest to become a best-in-class operator. We also continued to build for the future, deploying €110 million in acquisitions. We’re now a stronger and more balanced company, comprised of high-quality leading franchises. We believe the combination of our exceptional portfolio and talented team provides a strong foundation for 2022 and beyond, while advocating to our stakeholders the value of water. "

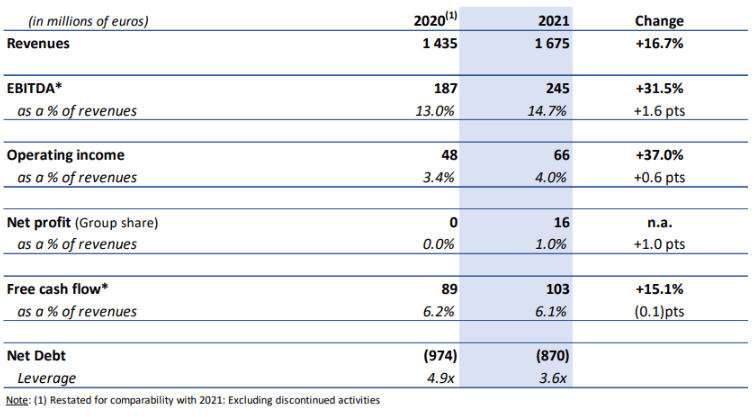

Key figures

In 2021, Saur’s results were very strong. In a context of economic recovery, Saur has been able to be agile in deploying its investments to provide innovative solutions and evolve its positioning as a strategic partner to its customers.

Saur reported revenues of €1 675 million in 2021, up +16.7%. Acquisitions had a net impact on growth of 8.3 points, mainly due to the consolidation of Aquapor from January 1st, 2021. Organic growth (i.e. excluding the impacts of changes in Group scope) is therefore +8.4%.

2021 was also a year of significant commercial successes. Water France Services achieved €53 million of new wins, a new record, and closed the year with a positive commercial balance. Water Services International recorded significant wins in the Iberian Peninsula, Saudi Arabia and Cyprus. Industry Water Solutions closed the year on a very strong note with significant projects won.

EBITDA, our primary performance indicator, is up +31.5% to €245 million. The margin rate is significantly higher (+1.6pts) than 2020, owing both to the consolidation of Aquapor and Saur’s focus on providing value solutions to clients.

Operating expenses represent 85% of revenues in 2021 amounting to €(1 429) million. Other operating costs of €(41) million correspond mainly to restructuring and transformation actions carried out in the year and acquisition-related costs.

Saur’s operating income is therefore up +37.0% at €66 million, or 4.0% of revenues.

Financial expenses are €(43) million in 2021, compared with €(31) million in 2020. The increaseis primarily due to costs incurred in connection with the refinancing transaction.

The income tax expense is €(6) million compared with €(9) million last year. It includes a tax benefit resulting from a change in French tax regulation (CVAE).

Net profit (Group share) is €16 million in 2021.

Free cash flow generation totaled €103 million, up +15.1% compared to 2020. This performance reflects the strong EBITDA combined with a marked improvement in working capital.

In 2021, Saur invested 110 million euros net in acquisitions to grow internationally and become more balanced.

The Executive Chairman has decided to not recommend to the General assembly the payment of a dividend for the year ended December 31st, 2021.

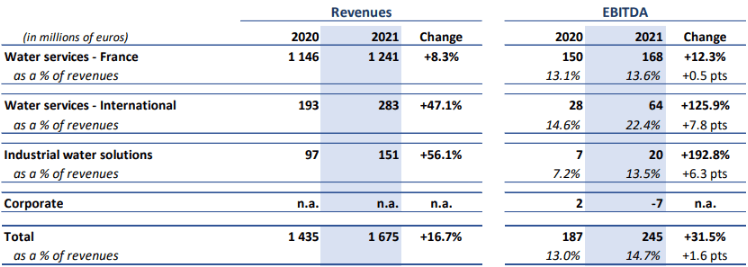

Business Units

Water services - France

Water services activities grew +8.3% to €1 241m. Organic growth was +8.7%. The French water services, including Operations & Maintenance (O&M) and Works had an excellent year.

Operations & Maintenance (O&M) was overall strong during the year, despite a rainy summer. Performance plans contributed significantly to EBITDA growth.

Works activity grew double digit. The growth in works reflects the increased commercial and execution resources allocated to the business and was made possible by the new set-up put in place

Water services - International

International water services activities grew +47.1% to €283 million, organic growth was +4.9%. EBITDA reached €64 million in 2021.

Commercial wins and new partnerships paving the way in the Middle East while Saur has consolidated its position in established markets.

Following the acquisition of Aquapor and its successful integration in 2021, Saur group is now the third largest water operator in the Iberian Peninsula.

Industrial water solution

Building on the successful 2020 acquisitions (Nijhuis, Econvert and Unidro), Industrial water solutions is on track to become a global powerhouse.

Industrial water solutions revenues grew by +56.1% to €151 million. At constant perimeter, organic growth was +12.5%. EBITDA reached €20 million in 2021, improving last year’s performance threefold.

Industrial water solutions 2021 order intake was up +60% at constant perimeter.

Balance Sheet

Saur strengthened its balance sheet in 2021 by successfully issuing Sustainability-Linked Bonds for a total nominal amount of €950 million. With this transaction, the Group refinanced its debt and extended its maturity.

At December 31st, 2021, the Group had cash and cash equivalents of €214 million. After accounting for borrowings, Group net debt is €870 million at December 31, 2021, down significantly compared with €974 million at December 31, 2020.

Group leverage is 3.6x as of December 31, 2021.

ESG

During 2021, the Saur group has structured its commitment to sustainable development around an ambitious roadmap, which serves its new corporate purpose. The objectives of saving water, reducing our carbon footprint, and increasing the number of women in executive positions, to which our sustainable obligations are linked, are an integral part of this roadmap and have already been the subject of very concrete actions, such as the signing of a first corporate PPA with Engie for the purchase of renewable electricity.

Outlook

Saur has strong ambitions for 2022 translating into the following guidelines:

- Revenue growth: Double digits

- EBITDA: Profitable growth

- Committed to investment grade rating

Conference call

Patrick Blethon, Chief Executive Officer and Albin Jacquemont, Chief Financial Officer, will present this press release during a conference call in English to be held today at 11.00 a.m. Paris time (CET). This press release will be published on the Investors page of the website of Saur.

Disclaimer

We are providing this information voluntarily, and the material contained in this announcement is presented solely for information purposes and is not to be: (i) construed as providing investment advice; (ii) relied upon or the form the basis for any investment decisions; or (iii) regarded as a recommendation or an offer to sell, or a solicitation of any offer to buy any securities or other form of financial asset.

This presentation contains forward-looking statements which are based on current plans and forecasts of Saur’s management. Such forward-looking statements are by their nature subject to a number of important risk and uncertainty factors that could cause actual results to differ in a variety of substantial and very material respects from the plans, objectives and expectations expressed in such forward looking statements.

No representation or warranty, express or implied, is provided in relation to the fairness, accuracy, correctness, completeness or reliability of the information, opinions or conclusions expressed therein.

These such forward-looking statements speak only as of the date on which they are made, and Saur undertakes no obligation to update or revise any of them, whether as a result of new information, future events or otherwise (and has no notification obligations to any person in this regard). It should not be regarded by recipients as a substitute for the exercise of their own judgment. Neither Saur, nor any of its directors, officers, employees, affiliates, direct or indirect shareholders, advisors or agents accepts any liability for any direct, indirect, consequential or other loss or damage suffered by any person as a result of relying on all or any part of this announcement and any and all liability is expressly disclaimed.